ATM withdrawal limit. Limits on cash withdrawals from plastic cards of the Savings Bank. What is the withdrawal limit for?

The restriction on cash withdrawals by Sberbank is set depending on the type and class of the card. The amounts also depend on the timing (daily, monthly limit), location (the maximum withdrawal amount at the ATM / at the cash desk differs in Sberbank) and, sometimes, the number of transactions.

All these numbers change periodically - banks are more and more actively trying to teach us to use non-cash payments. For example, in May 2015, the monthly limits for gold, platinum and black cards were reduced by 3 times, and the changes also affected the simplest Momentum cards. But first things first.

The limit for cash withdrawals at Sberbank through an ATM in 2018 for a single operation is tied not only to the amount, but also to the number of bills. It is 40 bills.

Accordingly, if all denominations are loaded in the device, then the maximum is 200,000 rubles in denominations of 5000. Now let us tell you what limit for withdrawing cash from a Sberbank card is set for each type of issued cards.

Withdrawing cash from a Sberbank debit card

Sberbank Momentum card - withdrawal limit:

- 100,000 rubles a month through an ATM or cash desk of Sberbank;

Mastercard Maestro and Visa Electron of Sberbank - withdrawal limit:

- 500,000 rubles a month through an ATM or cash desk of Sberbank;

- 50,000 rubles a day through the cashier or ATM.

Visa Classic and Master Card Standard - limit:

- 1,500,000 rubles per month through an ATM or cash desk of Sberbank;

- 150,000 rubles a day through the cashier or ATM.

Gold cards - limits:

- 3,000,000 rubles a month through an ATM or cash desk of Sberbank;

- 300,000 rubles a day through a cashier or ATM.

Platinum cards - limits:

- 5,000,000 rubles a month through an ATM or cash desk of Sberbank;

- 500,000 rubles a day through the cashier or ATM.

The limit of operations with the Sberbank card is limited to 100 operations.

How to withdraw a large amount from a Sberbank card?

Before withdrawing a large amount from a Sberbank card, you can open a regular savings account (at a bank branch or in your Internet bank) and make a free intrabank transfer. There are no restrictions on withdrawals from this account.

Checkout limits

In branches, you can withdraw much more substantial amounts, but there are still limits. The main difference is that the restrictions here are set on the amount of funds that can be received in your hands within a month, and not per day.

- Visa Platinum, Platinum Master Card. The allowed amount is a record high - 50,000,000 rubles (1,500,000 USD, 1,000,000 EURO) per month;

- Visa Gold, Gold Master Card. With such a card, you can receive up to 10,000,000 rubles (400,000 USD, 300,000 EURO) monthly at the cash desk of Sberbank;

- other Sberbank cards allow you to withdraw in cash only 5,000,000 rubles (200,000 USD, 150,000 EURO) in one month.

As a rule, for a one-time withdrawal of a large amount from the account, it is necessary to notify the bank employees in advance about the planned operation. In addition, you should remember about the amount of the amount dispensed free of charge daily (usually it corresponds to the ATM dispensing limit) - the tariffs for excess are 0.5 percent of the difference.

Cash desks of third-party financial organizations

There are no limits for withdrawing funds at the cash desks of other credit and financial companies, so you can get there any amount established by the rules of a particular organization. It is not very profitable to withdraw cash in this way - the interest charged is much higher than in Sberbank branches.

ATM limits

The restrictions on the maximum amount are the same for ATMs serviced by Sberbank and for those belonging to other banks - but here there is a difference in the additional commission: 1 percent of the amount, but not less than 100 rubles (3 US dollars or 3 Euros).

Cash withdrawal limit Money on the card account at ATMs, branches of Sberbank of Russia and their internal structural divisions:

| Account currency Rubles | Account currency EURO | Account currency USD | |

| For all card products except Visa Gold, Gold MasterCard and above | RUB 5,000,000 per month, including through an ATM - no more than 150,000 rubles. per day | 150,000 Euro per month, including through an ATM - no more than 4,500 Euro per day | 200,000 USD per month, including through an ATM - no more than 6,000 USD per day |

| Visa Gold, Gold MasterCard |

RUB 10,000,000 per month, including through an ATM - no more than 300,000 rubles. per day | 300,000 Euro per month, including through an ATM - no more than 9,000 Euro per day | 400,000 USD per month, including through an ATM - no more than 12,000 USD per day |

| Visa Platinum, Platinum MasterCard |

RUB 50,000,000 per month, including through an ATM - no more than 1,000,000 rubles. per day | 1,000,000 EURO per month, including through an ATM - no more than 20,000 EURO per day | USD 1,500,000 per month, including through an ATM - no more than USD 25,000 per day |

Banks Today Live

Articles marked with this sign always relevant... We are watching this

And the comments on this article are answered by qualified lawyer and the author himself articles.

Like any other financial institution, Sberbank sets its own restrictions on the withdrawal of cash from plastic cards.

In order not to find yourself in an unpleasant situation, and to avoid possible disputes with bank employees, you need to know and understand: “What is a limit? How much money can be withdrawn, and what do such restrictions depend on? "

The withdrawal limit is the restrictions set by the bank on receiving money using a plastic card. In other words, the user will not be able to withdraw a large amount of money from the card. Only the threshold amount will be available to him.

The maximum limit level is set by the Central Bank. However, banking institutions can change the withdrawal restrictions at their discretion. The main thing is that the amount does not exceed the threshold established by law.

Withdrawing money is possible from both debit and credit cards. There are restrictions on both one and the other. The concept of a "credit card limit" is slightly different. In particular, it means - the maximum amount of money that the bank can give out to the client, as borrowed funds. This amount depends on the client's ability to pay and on his credit history.

The debit card limit is set based on the wishes of the bank itself, and depends on the following factors:

- A kind of plastic card;

- Cash withdrawal method;

In addition, restrictions on plastic cards may also differ.

The limit for withdrawing cash from a Sberbank card is of the following types:

- One-time;

- Daily;

- Monthly.

Based on the names, we can conclude that a one-time limit is the amount that a plastic card user can withdraw in one operation. Daily limit - the amount available for withdrawal during the day. Monthly limit - the amount available for one month.

What are the limits for withdrawals at ATMs of Sberbank

You can withdraw cash from Sberbank plastic cards both at ATMs owned by the bank itself and at third-party banks. There is only one ATM withdrawal limit, and does not depend on the affiliation to a particular financial institution. However, it is worth remembering that when servicing at other ATMs, a commission of 1% of the withdrawal amount will be taken from the user, but not less than 100 rubles.

The daily limit for cash withdrawals from Sberbank ATMs is 50,000 rubles.

For more information on withdrawing money through an ATM, see the table:

| Map view | Daily limit for an account in rubles | Monthly limit in rubles | Daily limit for USD account | Monthly limit in dollars | Daily limit for EUR account | Monthly limit in EUR |

|---|---|---|---|---|---|---|

| Visa Gold, | 300 000 | 10 000 000 | 12 000 | 400 000 | 9 000 | 300 000 |

| Visa Platinum, Platinum MasterCard |

1 000 000 | 50 000 000 | 25 000 | 1 500 000 | 20 000 | 1 000 000 |

| Classic card products | 150 000

100,000 - for social, student |

5 000 000 | 6 000 | 200 000 | 4 500 | 150 000 |

What are the restrictions on withdrawals at the cash desks of Sberbank

You can also withdraw cash from a card account through the cash desks of Sberbank. The available withdrawal amount will be significantly higher.

It is important to remember that in bank branches, not the daily, but the monthly limit on the Sberbank card will be taken into account.

In order to cash out a large amount of money in Sberbank branches, it is necessary to notify employees of this intention in advance, and to have with you not only a card, but also a passport.

It should be borne in mind that for carrying out such operations, an additional commission may be charged from the user, in accordance with the established tariffs of the bank.

Limit size for cash withdrawals at cash desks and ATMs of third-party banks

You can get cash from a Sberbank plastic card at any other bank. Regardless of where the transaction will be carried out through a cashier or ATM, there are the following limits:

It is important to remember that third-party banks will in any case withhold commission in accordance with their tariffs.

As noted above, absolutely all banks set the size of restrictions in accordance with their own rules. For example, VTB 24 Bank has set the following limits:

As you can see from the tables, the amount of the limit can be different. But the fact remains unchanged that the higher the status of the client's card, the more favorable its tariffs and conditions.

Sberbank is the largest financial institution in the country. It serves more than 4 million clients, 85% of them have plastic cards in their hands. In order for each of the clients to trust the bank and be calm about their money, a limit was introduced. It is believed that such restrictions will allow holders to protect themselves from fraudsters. In addition, the withdrawal of large sums of money is possible only if there is confirmation from the cardholder.

Moreover, the bank is interested in making more non-cash transactions, which allows customers to make a huge number of payments without commissions and without leaving home.

Sometimes I need to withdraw a lot of cash, but ATMs often have a limit on the amount. For example, you have to shoot many times for 7,500 rubles. It is still a pleasure to go to different ATMs in order to withdraw the entire required amount. Where can you find such ATMs to withdraw a lot of cash at once?

Igor, it is not entirely clear from your question what a lot of cash means to you. But in general, you can find such ATMs. It is important to distinguish between the spending limit on the card and the limit of the ATM itself for a one-time withdrawal of funds.

Michelle Korzhova

financial advisor to Tinkoff Bank

Card limit

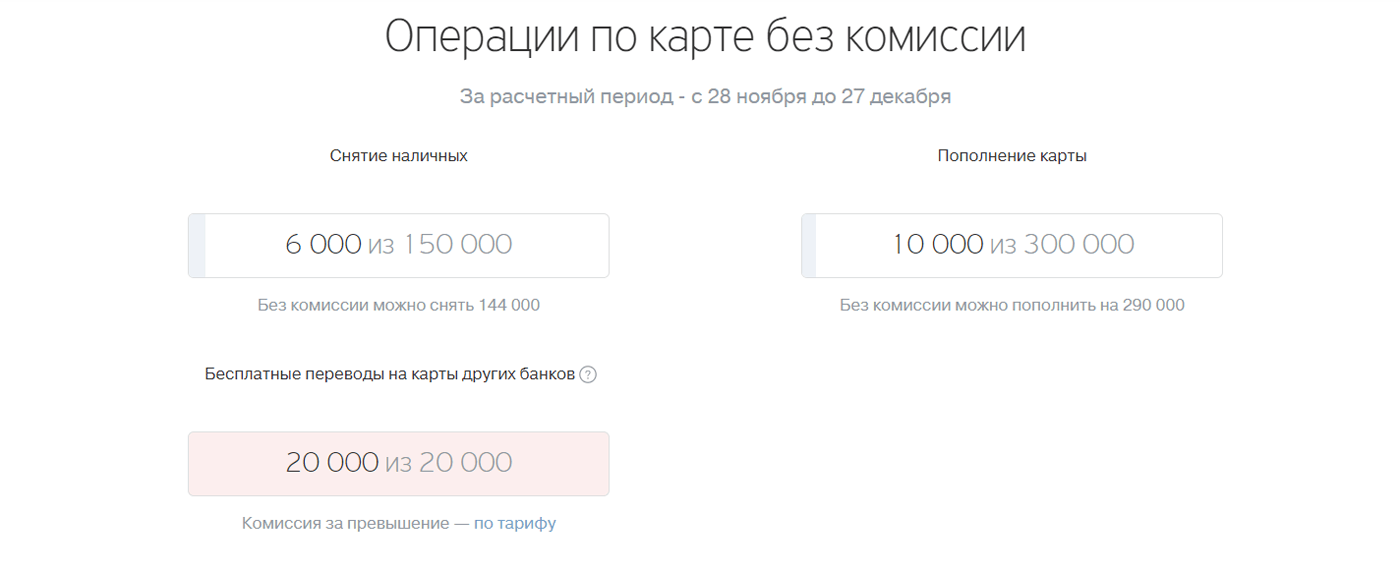

Any card has a spending limit for cash withdrawals. The limit is daily and monthly.

You can check your cash withdrawal limit at personal account, mobile bank or by calling the bank's call center.

For example, with debit cards of Tinkoff Bank, you can withdraw 150,000 rubles for the billing period. When withdrawing through Tinkoff ATMs, you can additionally withdraw 150,000 RUR for the billing period without commission. If you withdraw more, there will be a commission: 2% of the amount withdrawn, but not less than 90 rubles.

You can set yourself a cash withdrawal limit on your own. This is necessary to protect yourself from fraudsters. I set the limit when I went on a trip to Asia - there are many cases of skimming or just card theft.

If you need to withdraw a lot of cash at once, I recommend that you notify the bank about this. For example, write to the support chat. Otherwise, the bank may decide that fraudsters are trying to withdraw money from the account, and will block the card. This is not fatal: it is easy to reissue or unlock, but the card will be unavailable for a while.

ATM limit

Another withdrawal limit may be at the ATM itself, especially for cardholders of third-party banks. The limitation can be in terms of amounts, for example, a maximum of 7,500 or 75,000 rubles per operation. Limit information is usually indicated on the ATM display before the transaction. There may also be a limit on the number of bills, for example, no more than 30 bills at a time. At the same time, no one will tell you how many bills are now left in a particular ATM.

The Tinkoff Bank website has a service where you can find the nearest ATMs and check which ATMs can withdraw how much money from. The information on the map is indicated for reference and is regularly updated. More detailed information can be obtained from the support service of the bank that owns the ATM.

How to shoot safely

In advance, you can still call the bank and inform which branch you plan to receive cash from. This is necessary so that it does not suddenly turn out that there is not enough money in the cash register. Also, large amounts can be withdrawn through the bank's partners, you can check with your bank for details.

If you have a question about personal finances, credit history or family budget, write: [email protected] We will answer the most interesting questions in the magazine.

Any client of Sberbank who has plastic cards acts on the basis of a service agreement drawn up and signed with a banking organization. This document sets out the basic rules for the use of cards, which the plastic holder undertakes to comply with. And the bank, in turn, provides a wide range of services, including settlement and cash services.

One of the types of services provided by Sberbank to its customers is the cashing of funds stored on the card. But, given that the uncontrolled flow of real money can provoke an increase in inflationary processes, banks are introducing restrictions on the withdrawal of money. Consider what is the limit for withdrawing money from the Sberbank MIR card per day, because this plastic is actively gaining momentum and becoming popular among Russians.

The limits for cash withdrawal from the MIR card are similar to the conditions for cards of other payment systems in SberbankWhat is the withdrawal limit for?

One of the important tasks of any banking system is to control the limitation of cash ("live" money). If the cash savings of citizens turn out to be too much monetary units, this can lead the country to the development of inflationary processes. Then the Central Bank of the Russian Federation will be forced to print new, fresh bills, which will further provoke a depreciation of the ruble and a rise in prices.

Reducing and controlling the cash that circulates in circulation allows us to solve the most important macroeconomic problems.

Banking organizations are also personally interested in setting strict limits. After all, in this way, your own financial position is strengthened. Unlimited cash withdrawals by account and card holders can undermine the position of banks. By the way, similar situations have already happened. For example, in 2008, the Ukrainian banks Prominvets and Nadra significantly increased their financial problems when clients cashed out most of their accounts and deposits at once.

What are the limits for Sberbank cards

The main bank in Russia has introduced two types of cash withdrawal limits. It:

- Daily (or daily).

- Monthly.

These rules are established and regulated by the laws of banking customers. The very border of the limits is not the same and depends on the type of plastic media. Its level is influenced by the presence of the privileges available to the plastic. The limit will be different for:

- premium cards;

- momentum cards (instant issue);

- plastic of the international and Russian national system.

Also, the type of monetary medium affects the border of the limits: debit or credit. It is noticed that the more gradations for classes the cards have, the less the number of available restrictions. The most loyal requirements are set for Gold plastic (premium cards).

The current limits for the most common Sberbank cards

The current limits for the most common Sberbank cards Current limits on the MIR card

For holders of plastic from the national monetary system, one of the pressing issues related to limiting is the border of withdrawing cash in one go. Sberbank has rules for a one-time transaction and they relate to the number of issued bills.

When cashing out money through self-service devices, the terminal informs the client about the banknotes available in the money pool (their nomination).

A one-time cash withdrawal transaction cannot exceed 40 bills of the selected denomination. Sometimes a problem arises when the requested amount is less than the required amount (due to the issuance of small denomination notes). The client has to withdraw money again, a day later.

Daily restrictions

The daily limit for cash withdrawals from the Sberbank MIR card is described in the following table:

Monthly restrictions

The total amount of funds available for cashing out is the sum of the daily limits... Requirements for MIR cards from Sberbank are described in the following table:

As you can see, the possibilities of withdrawing cash for clients, holders of MIR plastic, are quite wide, capable of satisfying the needs of middle-income consumers. Of course, premium cards offer a higher issuance potential. Cash carriers with unlimited cashing are not provided in Sberbank (they do not exist in other banks either).

More detailed information on the current rules and restrictions on Sberbank cards can be found on the official website of the bank

More detailed information on the current rules and restrictions on Sberbank cards can be found on the official website of the bank Features of withdrawing from a debit card

Not all Sberbank clients who own debit plastic know that the banking structure allows you to exceed the cashing rate. To do this, you only need to issue an appropriate application. It should be understood that when performing withdrawal transactions within the established limit, no commission is charged, but they will have to be paid if, at the request of the client, the established limits are increased. The commission is equal to 0.5% of the requested amount.

Credit card conditions

At the moment, it is impossible to issue a MIR credit card in Sberbank (due to their recent appearance on the market, there is still little demand). But there are prerequisites to assume that in the near future this largest bank in Russia will also start issuing credit cards for the national payment system. Therefore, it is worthwhile to sanctify the current rules for credit plastic of a different standard. They are as follows:

- monthly limit is not set;

- cash out is allowed only in the established software credit agreement daily rates;

- there is a grace period (it is active for 50 days), during the period of its validity, interest is not calculated, then the grace period is terminated when cashing out funds;

- when cashing borrowed funds, a commission is charged from the client (their percentage is indicated in the loan obligations and is equal to 3% when withdrawing money at the bank's offices and 4% when cashing out through terminals).

How to withdraw an amount in excess of the prescribed limit

This question often worries the owners of debit plastic. Sberbank offers several solutions:

- Upon request. To do this, you can contact customer support specialists (call center workers). After receiving approval for a specific card, the withdrawal limit will be increased and available at any ATM.

- Office visit. To do this, you should come to the local branch of Sberbank and seek advice from the manager. After approval of the operation, the limit is increased.

- Open multiple debit cards. Then withdrawing the required amount of money will be quite affordable, even if you want to cash out more than the threshold set by the bank.

You can also use a money order. For example, transfer the required amount (if it exceeds the limits of what is permitted) to relatives' cards or to your own plastic from another bank. And then withdraw the required amount.

The limits are also valid when conducting transactions in Sberbank-Online.

The limits are also valid when conducting transactions in Sberbank-Online. Where can I withdraw money from the Mir card

You can cash out the debit plastic of the MIR payment system from Sberbank in various ways. In addition to Sberbank ATMs, terminals of other banking systems can also be used. The methods that can be used when withdrawing money from a MIR card are as follows:

- At the bank branch. To transfer, you must show your passport, card and indicate the amount of withdrawal. In this case, the recipient will have to pay a commission of 1%.

- Through the terminal. Insert the card and activate it by entering the PIN. Then select the appropriate option from the main menu, collect the required amount for withdrawal and receive it. You can print a check. It is worth knowing that if the PIN is entered incorrectly three times in a row, the bank will block the card, and it will become active only the next day.

You can cash out a MIR card using ATMs of third-party banks. But you should know that you will have to pay a commission. By the way, if you use the banking terminals of Sberbank's partner banks, the commission will not be charged... These are the following banking organizations:

- Uniastumbank;

- Rosselkhozbank;

- Admiralty Bank.

conclusions

According to statistics that Sberbank regularly conducts, recently there has been a decrease in cash turnover in favor of making non-cash payments that are made using Sberbank cards. According to the reviews of plastic holders, it is much more convenient and comfortable to use when making payments with cards. Well, if necessary, you can always withdraw cash, taking into account the existing rules.

Sberbank offers its customers more than 40 types of bank cards. They differ in the connected set of services, the established limit on the circulation of funds, and the cost of service. All cards have monthly and daily limits for withdrawing cash from ATMs and bank branches. The daily cash withdrawal limit depends on the card series. The most elite options are Platinum and Gold cards, they are intended for VIP-clients who operate with significant amounts of money.

How the limit is calculated

Withdrawal limit is a certain amount of money available for withdrawal during a day, week or month. Restrictions apply to both cash withdrawal and internal wire transfers. Also, the limit is called the available balance on a credit card.Sberbank sets a limit on the card depending on its type. There are more than 10 types of bank cards - debit, pension, instant (Momentum), classic, premium, gift, gold and others. The higher the status, the more opportunities and fewer restrictions.

If the withdrawal of money is carried out at the cash desk of Sberbank, then the daily limit is practically unlimited. Significant restrictions are imposed on operations carried out using automated services. On platinum and gold cards, the limit has been significantly increased.

The established limit also depends on the branch in which the card was issued. Sberbank subsidiaries in Ukraine, Belarus and Kazakhstan set stricter restrictions than the bank's Russian branches.

Card type restrictions

The daily limit for withdrawing cash from a Sberbank card depends on the card series:- ordinary (non-premium) cards have an established monthly limit of 150 thousand rubles, 6 thousand dollars or 4.5 thousand euros;

- Premium cards of the Gold series ("gold") from Sberbank have a limit of 300 thousand rubles, 12 thousand dollars or 9 thousand euros;

- platinum cards (Platinum) have the highest limit - 1 million rubles, 25 thousand dollars or 20 thousand euros.

For cards of the first level, which were issued by subsidiaries of Sberbank, an additional limit is set on the maximum amount of one operation. This limitation for VISA Electron Momentum is $ 250 for a currency account or 7,500 rubles for a regular one. If you need to transfer a large amount, you will need to carry out several transactions in a row - the existing restrictions do not cover this possibility. Award cards issued by divisions from subsidiaries, have higher limits - 2,000 dollars or 50 thousand rubles.

In addition to the daily limit, the bank has set limits on the monthly spending of funds. For standard cards, this is 5 million rubles (200 thousand dollars and 150 thousand euros); for the Gold series - 10 million rubles ($ 400 thousand and € 300 thousand); for platinum cards - 50 million rubles (1.5 million dollars and 1 million euros). The daily limit for withdrawing cash from a Sberbank card applies to all types of withdrawals, including operations using an ATM.