Appendix 3 to the RSV. Calculation of insurance premiums - Extern. Additional social security contributions

Starting in 2017, a new reporting form appeared - calculation of insurance premiums. This reporting was approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551@. In this article, we will look at who is required to submit a calculation of insurance premiums, within what time frame, what liability is provided for violating the deadline, and we will look at the procedure for filling it out.

Who should submit calculations for insurance premiums?

(KND 1151111)?Article 419 of the Tax Code of the Russian Federation specifies the persons by whom the Calculation must be submitted. This category includes persons making payments and other remuneration to individuals:

- organizations;

- individual entrepreneurs;

- individuals who are not individual entrepreneurs.

Where is the calculation of insurance premiums submitted?

(KND 1151111)?The calculation must be submitted to the tax authority:

- organization - at the place of registration;

- individual entrepreneur - at the place of residence;

- separate divisions - at the place of registration, if they are vested with the authority to calculate payroll. Information about vesting a separate division with the appropriate powers must be transferred to the tax authority within 1 month. If a separate division does not calculate wages, then the calculation is presented by the parent organization at the place of registration (Letter of the Federal Tax Service dated January 23, 2017 BS-4-11/993@).

Within what time frame must the Calculation of Insurance Premiums be submitted (KND 1151111)?

The calculation must be submitted no later than the 30th day of the month following the reporting period, and at the end of the year - no later than the 30th day of the month following the accounting period.

The reporting period is recognized as 1st quarter, half a year, 9 months. The billing period is a calendar year.

Please note that the deadline for submitting the Calculation is the same and does not depend on the method of presentation.

What are the methods for submitting the Calculation of Insurance Premiums (KND 1151111)?

Employers whose average number of individuals to whom payments and other remunerations are made for the previous billing (reporting) period exceeds 25 people, as well as newly created organizations with more than 25 people, must submit a Calculation using an enhanced qualified electronic signature according to the TKS .

If the number is 25 people or less, then the Calculation can be presented in any of the following ways:

- via TKS using an enhanced qualified electronic signature;

- in person to the Federal Tax Service;

- sent by mail, but always with a description of the attachment.

Note! You can easily prepare and submit reports on insurance premiums using the “My Business” online service. The service automatically generates reports, checks them and sends them electronically. You can get free access to the service right now by following this link.

How to fill out the Calculation of Insurance Premiums (KND 1151111)?

The calculation is completed in rubles and kopecks. All cells must be filled in; if there are no indicators, put dashes.

The calculation includes a title page and three sections:

- Section 1 - “Summary data on the obligations of the payer of insurance premiums.” This section includes 10 applications.

- Section 2 - “Summary data on the obligations of insurance premium payers - heads of peasant (farm) farms.” This section contains 1 application.

- Section 3 - “Personalized information about insured persons.”

All employers are required to pass:

- Title page;

- Section 1 - “Summary of the obligations of the payer of insurance premiums”;

- Subsections 1.1 and 1.2 of Appendix 1 to Section 1 - “Calculation of the amounts of insurance contributions for compulsory pension and health insurance”;

- Appendix 2 to Section 1 - “Calculation of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity”;

- Section 3 - “Personalized information about insured persons.”

All other subsections and applications are filled out only if there is data on them.

The detailed procedure for filling out is given in Appendix 2 to the Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551@.

When is the Calculation of Insurance Premiums (KND 1151111) considered not submitted?

- discrepancies between the amount of pension contributions for each employee and the total amount of insurance contributions;

- indications of inaccurate personal data.

The tax authority sends a corresponding notification to the policyholder no later than the day following the day of receipt of the Calculation. If the Calculation was submitted on paper, the policyholder will receive the notification 10 days following the day the tax authority received the Calculation.

After receiving the notification, the policyholder must, within five days (notification in electronic form) or within ten days (notification in paper form), eliminate all inaccuracies and submit the Calculation. In this situation, the deadline for submitting the Calculation is the deadline for submitting the initial Calculation.

What is the liability for violation of the deadline for submitting the Calculation of Insurance Premiums (KND 1151111)?

If the Calculation is submitted in violation of the submission deadline, a fine is imposed - 5% of the amount of insurance premiums indicated in the report for each full or partial month of delay. But the fine will be no less than 1000 rubles and no more than 30% of the amount of insurance premiums reflected in the statements. Penalties are regulated by clause 1, clause 3, article 76 of the Tax Code of the Russian Federation.

Blocking of the current account in case of violation of the deadline for submitting the Calculation is not provided.

Is it necessary to submit the Calculation of Insurance Premiums (KND 1151111) with zero indicators?

The calculation must be submitted by the payers of insurance premiums, i.e. organizations and persons making payments and other remuneration to individuals within the framework of labor relations and civil contracts.

The Tax Code does not provide for an exemption upon submission of a Calculation in the event of failure to carry out financial and economic activities.

When submitting a zero Calculation, the payer thus declares that there are no payments that are subject to insurance premiums.

The issue of the need to submit a Calculation with zero indicators was discussed in the letter of the Federal Tax Service dated 04/03/2017 No. BS-4-11/6174.

Sample of filling out a zero calculation for insurance premiums (KND 1151111)

Title page of the zero Calculation of insurance premiums (KND 1151111)

Section 1 of the zero Calculation of insurance premiums (KND 1151111) - “Summary data on the obligations of the payer of insurance premiums”

Subsections 1.1 and 1.2 of Appendix 1 to Section 1 of the Zero Calculation of Insurance Contributions (KND 1151111) - “Calculation of the amounts of insurance contributions for compulsory pension and health insurance”;

Appendix 2 to section 1 of the zero Calculation of insurance premiums (KND 1151111)

- “Calculation of the amount of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity”;

Section 3 of the zero Calculation of insurance premiums (KND 1151111) - “Personalized information about insured persons”

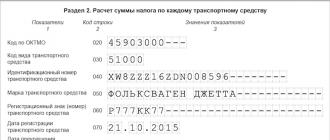

ART LLC (general taxation system) pays its only employee Anatoly Viktorovich Stepanenkov a salary in the amount of 13,500.00 rubles. There are no other incomes subject to insurance premiums.

Calculation of insurance premiums (DAC) is a single report that combines information on all insurance premiums, with the exception of data on occupational diseases and accidents. Reports on social contributions are now also accepted by tax authorities, so the Federal Tax Service has approved a single form of the document. We will talk about what the calculation of insurance premiums for the 1st quarter of 2019 is; You will also find a sample filling in the article. We will consider filling out the calculation of insurance premiums in all details: the instructions will be as detailed as possible.

The official name of the new report, approved by Order of the Federal Tax Service dated October 10, 2016 No. ММВ-7-11/551@, is “Calculation of insurance premiums”. But since it includes all information on existing insurance premiums, except for payments for occupational diseases and industrial accidents, accountants have already come up with a new name for it - Unified Settlement, or simply RSV. In fact, this form replaced the abolished RSV-1 and most sections of the 4-FSS form, which policyholders, as before, must submit to the Social Insurance Fund, but only “for injuries.”

Deadlines for submitting calculations for insurance premiums

A unified calculation of insurance premiums for 2019 (we will show an example of filling out below), in accordance with the norms of paragraph 7 of Article 431 of the Tax Code of the Russian Federation, must be submitted by all employers: both legal entities and individual entrepreneurs who have employees and make payments in their favor. The deadline for submitting this quarterly report is the 30th day of the month following the reporting period. For the first quarter of 2019, the date after which sanctions for late submission of the form will follow is 04/30/2019. The deadlines for submitting the report to the tax authorities for all reporting periods in 2019 are shown in the table:

Organizations where the average number of employees during the reporting period was more than 25 people, due to the requirements of paragraph 10 of Article 431 of the Tax Code of the Russian Federation, must provide the Federal Tax Service with a unified calculation of insurance payments (an example of filling out the DAM for the 1st quarter of 2019 is given below) in electronic form. Other employers are allowed to report on paper - you will have to fill out, print and send the form “Calculation of insurance premiums for the 1st quarter of 2019” - the form of the document in this case will be paper. The methods for delivering the DAM to the tax authority are no different from other forms and declarations: it can be brought in person, sent by registered mail, or transmitted through a representative.

Reporting of separate divisions

If the insurer has separate divisions that independently pay salaries to employees, then, by virtue of paragraph 7 of Article 431 of the Tax Code of the Russian Federation, each such division is obliged to submit its report to the tax authority at its location. In this case, it does not matter whether the separate division has its own separate balance sheet and current account. Moreover, the organization is obliged to notify the tax service in advance about the powers of its separate divisions to accrue and pay benefits to employees within a month, as provided for in Article 23 of the Tax Code of the Russian Federation. This obligation for all payers of insurance payments arose from 01/01/2018, and parent organizations must also declare themselves by submitting an application, the form of which was approved by Order of the Federal Tax Service of Russia dated 01/10/2017 No. ММВ-7-14/4@. It is also important for them to know the rules for filling out the DAM for the 1st quarter of 2019: instructions for filling out are published below.

Unified calculation of insurance premiums 2019: form

So, let's see how to make a single calculation for insurance premiums: the form contains 25 sheets (together with attachments) and consists of:

- title page;

- Section 1 “Summary data on the obligations of the payer of insurance premiums”;

- Section 2 “Summary data on the obligations of insurance premium payers - heads of peasant (farm) farms”;

- Section 3 “Personalized information about insured persons.”

Which section needs to be completed and to what extent depends on the status of the policyholder and the type of activity he carries out. The table shows the categories of employers and the subsections of the calculation that they must fill out.

|

What needs to be filled out in the RSV |

|

|

All insurers (legal entities and individual entrepreneurs, except heads of peasant farms) |

|

|

In addition, you must fill out: |

In addition to the above: |

|

Policyholders who are entitled to reduced or additional social security rates |

|

|

Insurers who, during the reporting period, had expenses associated with the payment of compulsory social insurance to individuals in the event of temporary disability and in connection with maternity |

|

Filling example

Directions and instructions for filling out the DAM reporting form for the 1st quarter of 2019 are given in Appendix No. 2 to the order by which it was approved. Pages must be numbered consecutively. When filling out a document on a computer for further printing, you must use only the Courier New font with a size of 16-18.

There is no need to round the cost figures in the report; you can indicate rubles and kopecks. If there is no indicator in the field, you need to put dashes; if there is no value indicator, zeros should be entered. Any corrections, stapled sheets, or double-sided printing of the document are strictly prohibited. Next, we will show a sample of filling out the calculation of insurance premiums for the 1st quarter of 2019, we will tell you how to calculate insurance premiums in 2019 - the example was prepared taking into account the latest legal requirements.

Instructions for filling out calculations for insurance premiums in 2019

The form is quite voluminous, so we will consider the procedure for filling out the calculation of insurance premiums for 2019 in parts. For example, we will take an organization that began operating in the fourth quarter of 2018. It employs two people, including the director. One specialist provides legal services under a civil law contract. Therefore, payments in his favor are not included in the tax base for compulsory social insurance in case of temporary disability and in connection with maternity.

1. Title page. Here you must indicate the INN, KPP and the full name of the insured organization or full name. IP. We pay special attention to the reporting period code. In the reporting for the 1st quarter of 2019, we indicate the code “21”. You should also write down the reporting year, as well as the code of the tax authority to which the report was sent.

In addition, it is necessary to note who exactly is sending the document: the payer himself or his representative. The payer corresponds to the code “1”, and the representative – “2”. The date must be placed at the end of the sheet, and the authorized person must certify the entered information with his signature.

2. Section 1 contains summary data on the payer’s obligations, so it is necessary to indicate the correct BCC code for each type of payment. Accrued amounts are given monthly, separately for pension benefits. As well as social and health insurance.

If there was additional insurance during the reporting period, this must also be indicated separately. The entire section 1 does not fit on one page, so you must continue filling it out on the next one. In this case, at the bottom of each page you must put a signature and date of completion.

3. Appendix 1 to Section 1 “Calculation of the amounts of insurance contributions for compulsory pension and health insurance.” Here you should indicate separately calculated insurance payments for pension and health insurance, as well as the number of insured persons in each month.

Subsection 1.2 “Calculation of contributions for compulsory health insurance” is completed in the same way.

4. Appendix 2 to Section 1 “Calculation of the amounts of insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity”, which accordingly provides data on the amounts calculated for the reporting period. It is very important not to forget to indicate how temporary disability benefits are paid: by offset or directly. Again, you need to indicate the number of insured persons and the amount of benefits paid.

On the next page you need to indicate the amounts of calculated payments, as well as the amounts spent on the payment of insurance coverage. Separately, it is necessary to note the amount reimbursed by the Social Insurance Fund.

5. Section 3. “Personalized information about insured persons” - here it is necessary to fill in the information of each employee or person in whose favor the remuneration was paid in the reporting period. Each person fills out their own separate sheet. It must indicate the reporting period code, the date of completion, TIN, as well as the serial number for the section.

After this, you must indicate the full name, INN, SNILS, gender and date of birth of each person.

Information about an identity document and a sign of insurance for each type of insurance are also required.

So, we filled out the insurance premium calculation form for the 1st quarter of 2019.

Errors and fines for the DAM in 2019

Since the reporting period for insurance premiums is a quarter, and the settlement period is a year, the tax authorities will punish for untimely submission of information on insurance transfers depending on which calculation was submitted late. If for a quarter, half a year or 9 months, then, by virtue of Article 126 of the Tax Code of the Russian Federation, the fine will be only 200 rubles for the reporting form itself, and not for the number of persons included in it. Tax legislation does not yet provide for such a “per capita” type of fine.

If the payment for the year was not submitted on time, you will have to pay 5% of the amount of insurance payments that were indicated in the document for each full or partial month of delay. The maximum amount of sanctions in this case, as defined by Article 119 of the Tax Code of the Russian Federation, cannot be more than 30% of the amount of contributions payable, but cannot be less than 1000 rubles. This means that if there is no obligation in the calculation, a fine of 1000 will still be imposed.

In addition, Article 76 of the Tax Code of the Russian Federation gives the tax service the right to block transactions on the current account of taxpayers who do not submit reports. Tax officials believe that now this rule will also apply to social contribution payers. However, the Ministry of Finance so far claims the opposite and allows accounts to be blocked only for failure to submit declarations.

Features of the refined calculation

Errors in the form will traditionally lead to the need to submit an updated calculation. This point is regulated, which states that only those sections of the document in which errors or inaccuracies were made will have to be filled out again. There is no need to duplicate sheets filled out without errors. Particular attention should be paid to section 3. Since it is submitted for each insured person separately, clarifications should be submitted only for those persons whose data has been changed.

In some cases, errors made by the policyholder may lead to the fact that the calculation will be considered not provided at all. In particular, this will happen if, in a single calculation of insurance premiums for the billing (reporting) period, the total amount of insurance premiums does not coincide with the amount for each insured person. If such a discrepancy is detected, the territorial body of the Federal Tax Service must notify the policyholder that his report has not been accepted no later than the day following the day the document was sent to the tax office. From this moment the policyholder has 5 working days to correct his calculation. If he meets this deadline, the date of the form will be considered the original date of its submission.

Unified calculation of contributions in accounting programs

DAM is included in all accounting and tax accounting programs and services:

From the 1st quarter of 2017, the calculation and payment of insurance contributions for compulsory pension, medical and social insurance (with the exception of contributions for injuries) is controlled by the Federal Tax Service.Instead of the forms "RSV-1", "RSV-2" and "RV-3", which until 2017 were presented in Pension Fund of Russia, and forms “need to be submitted to the tax authorities in a single calculation approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551@. It needs to reflect accrued insurance contributions to the Pension Fund, FFOMS and Social Insurance Fund.

Who reports on the RSV

The calculation of insurance premiums is filled out by payers of insurance premiums or their representatives (hereinafter referred to as payers): persons making payments and other remuneration to individuals (organizations, individual entrepreneurs, individuals who are not individual entrepreneurs).

According to the DAM, not only legal entities and individual entrepreneurs report, but also individuals and mediators.

Individuals using services under a rental agreement (having a gardener, a nurse, etc.).

Mediators are an independent legal entity engaged by the parties as intermediaries in resolving a dispute to develop a solution on the merits of the dispute.

When should the form be submitted?

In accordance with paragraph 7 of Article 431 of the Tax Code of the Russian Federation, persons making payments and other remuneration to individuals submit calculations for insurance premiums once a quarter no later than the 30th day of the month following the billing (reporting) period. Thus, in 2017, the deadline for submitting a new calculation for the first quarter will be on May 2, for the six months - on July 31, for nine months - on October 30, for the year - on January 30, 2018.

How is the calculation presented?

Payments to the tax authority in electronic form using an enhanced qualified electronic signature via telecommunication channels in accordance with clause 10 of Article 431 of the Tax Code of the Russian Federation are submitted by payers:

- in which the average number of individuals in whose favor payments and other remuneration are made for the previous billing (reporting) period exceeds 25 people;

- as well as newly created (including during reorganization) organizations whose number of individuals exceeds 25 people.

In accordance with paragraph 4 of Article 80 of the Tax Code, payers have the right to submit payments in electronic form via telecommunication channels, in person or through a representative on paper, or in the form of a postal item with a list of attachments:

- in which the average number of individuals in whose favor payments and other remuneration are made for the previous billing (reporting) period is 25 people or less;

- as well as newly created (including during reorganization) organizations whose number of individuals does not exceed 25 people.

What sections need to be filled out?

The title page is filled out by all payers without exception.

Section 1 (“Summary data on the obligations of the payer of insurance contributions”) contains summary data on the amounts payable for the billing (reporting) period for pension contributions, medical contributions and contributions for compulsory insurance in case of temporary disability and in connection with maternity. This section also reflects the amounts of contributions to the Pension Fund at the additional tariff and contributions for additional social security. These indicators should be indicated first in their entirety for the reporting period, and then broken down by month. For each type of insurance premium, the BCC to which the premiums are credited is indicated.

Also in the first section there are fields in which you need to reflect the amount of excess of compulsory social insurance expenses over the amount of contributions to the Social Insurance Fund (except for contributions “for injuries”).

There are ten appendices in Section 1. They show how the policyholder received summary data on the amounts of contributions payable and the amount of excess expenses over contributions to the Social Insurance Fund (except for contributions “for injuries”):

- Subsection 1.1 of Appendix 1, Subsection 1.2 of Appendix 1 and Appendix 2 are filled out by payers making payments and other remuneration to individuals.

Appendix 1 “Calculation of the amounts of insurance contributions for compulsory pension and health insurance.”

May be in several copies if the organization has several tariffs.

Subsections 1.1 and 1.2 correspond to Section 2.1 in the form “RSV-1 PFR”.

- Subsection 1.3.1 of Appendix 1 is filled out by payers applying additional tariffs without a special assessment of working conditions (SOUT) in accordance with paragraphs 1 and 2 of Article 428 of the Tax Code.

Corresponds to Subsections 2.2 and 2.3 in the form “RSV-1 PFR”.

- Subsection 1.3.2 of Appendix 1 is filled out by payers applying additional tariffs for classes of working conditions in accordance with paragraph 3 of Article 428 of the Tax Code.

Corresponds to Subsection 2.4 in the form “RSV-1 PFR”.

- Subsection 1.4 of Appendix 1 is completed by payers paying contributions for additional social security for flight crew members of civil aviation ships and coal industry workers.

Corresponds to the “RV-3” form.

If Appendix 1 is completed in several copies, subsections 1.3 and 1.4 must be completed in the first copy of Appendix 1.

- Appendix 2 filled in by payers making payments and other rewards to individuals.

Corresponds to Table 3 in the form"4-FSS".

- Appendix 3 and Appendix 4 are included in the calculation when the payer makes expenses for the payment of insurance coverage for compulsory social insurance in case of temporary disability and in connection with maternity.

Correspond to Tables 2 and 5 in the “4-FSS” form.

- Appendix 5 is filled out by IT companies applying a reduced tariff in accordance with subparagraph 3 of paragraph 1 of Article 427 of the Tax Code.

Corresponds to subsection 3.1 in the form “RSV-1 PFR”.

- Appendix 6 is filled out by payers on the simplified tax system, the main types of economic activities of which are specified in subparagraph 5 of paragraph 1 of Article 427 of the Tax Code.

Corresponds to subsection 3.2 in the form “RSV-1 PFR”.

- Appendix 7 is filled out by non-profit organizations applying a reduced tariff in accordance with subparagraph 7 of paragraph 1 of Article 427 of the Tax Code.

Corresponds to subsection 3.3 in the form “RSV-1 PFR”.

- Appendix 8 for individual entrepreneurs using the patent taxation system and a reduced tariff under subparagraph 9 of paragraph 1 of Article 427 of the Tax Code.

Exceptions:They rent out real estate that they own.

Engaged in retail trade through trading floors/locations.

Provide catering services.

- Appendix 9 is filled out for temporarily staying foreigners, in respect of whom a contribution is paid to the Social Insurance Fund at a rate of 1.8% in accordance with paragraph 2 of subparagraph 2 of paragraph 2 of Article 425 of the Tax Code, except for highly qualified specialists and citizens of states from the ESEC.

- Appendix 10 is filled out by organizations making payments and other rewards in favor of students in educational organizations for activities carried out in the student team for application in accordance with subparagraph 1 of paragraph 3 of Article 422 of the Tax Code. Payments are not subject to Pension Fund contributions.

Corresponds to Section 5 in the form “RSV-1 PFR”.

Section 2 is filled out by payers who are heads of peasant (farm) households. They must indicate the amount of pension and medical contributions accrued for the billing period, that is, for the year. In Appendix 1 of Section 2, information about the head and each member of the household is filled out.

Filled out for the reporting period - a year.

Section 3 is personalized information about the insured persons. Filled out in relation to each insured person working for the payer of insurance premiums under an employment contract or civil servants' agreement during the last three months of the reporting (calculation) period.

If nothing has been accrued to the insured person over the last three months, then subsection 3.2 “Information on the amounts of payments and other remunerations accrued by payers of insurance contributions in favor of an individual, as well as information on accrued insurance contributions for compulsory pension insurance” is not completed.

Corresponds to Section 6 in the RSV-1 PFR form.

What date is considered the date of submission of the report?

- When transmitting a settlement via telecommunication channels in accordance with Order of the Ministry of Taxes and Taxes dated 02.04.2002 N BG-3-32/169, the day of submission is considered the date of sending, recorded in the confirmation of a specialized telecom operator.

- When sending a calculation by mail in accordance with paragraph 4 of Article 80 of the Tax Code, the date of submission is considered to be the date of sending the postal item with a description of the attachment.

What date is considered the date of submission of the report?

- If the Federal Tax Service does not find any errors in the submitted report (that is, the information on the total amount of insurance premiums coincides with the amount of calculated insurance contributions for compulsory pension insurance for each insured individual), the date of submission will be considered the date of its submission.

- If errors are found in the submitted calculation (that is, information on the total amount of insurance premiums does not coincide with the amount of calculated insurance contributions for compulsory pension insurance for each insured individual or there are errors in the personal data of employees), then in accordance with paragraph 7 of Article 431 of the Tax Code the payer, no later than the day following the day of submission of the calculation (10 days following the day of receipt of the calculation on paper), is sent a corresponding notification.

Within five days from the date of sending the notification in electronic form (10 days if the notification is sent on paper), the payer is obliged to submit a corrective calculation in which errors are corrected. If the policyholder corrects everything on time, then the date of submission of the calculation will be considered the day of submission of the original, that is, uncorrected version.

Where to report to branches

- If a separate division (SU) is authorized to make payments to individuals, then the calculation is submitted at its location. In this case, the fact that the branch has its own current account and separate balance sheet does not matter.

We have compiled instructions for filling out calculations for insurance premiums in 2017 and provided ready-made examples for each section. You can download a sample of filling out the DAM for the 2nd quarter of 2017 in the article.

Submit the calculation of insurance premiums 2017 (DAM) using the form from the order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551@. The general deadline is no later than the 30th day of the month following the reporting period. But we can report on the results of the half year later. Due to the weekend, the deadline for submitting the calculation of insurance premiums for the 2nd quarter of 2017 was postponed to July 31.

How to fill out a new calculation for insurance premiums, which sections to submit

The Federal Tax Service consists of a title page and three sections. In turn, the first section includes 10 applications, and the second section - one.

For companies and entrepreneurs who have payments in favor of individuals, it is necessary to submit to the inspection the title page, section 1, subsections 1.1 and 1.2 of the first appendix, the second appendix to section 1 and section 3. Complete the remaining sections if there are the necessary indicators for this .

For example, if employees were paid benefits, you will need Appendix 3 to Section 1. Companies with harmful and dangerous working conditions include subsections 1.3.1 and 1.3.2 of Appendix 1 to Section 1 in the new calculation (DAM).

If the company calculated insurance premiums at reduced rates, appendices 5, 6 and 7 to section 1 must be completed, depending on the basis for paying insurance premiums at reduced rates.

General structure for calculating insurance premiums 2017

Instructions for filling out insurance premium calculations

Fill out the new calculation (DAM) in rubles and kopecks. Indicators of the amounts of payments and insurance premiums, the number of people, enter starting from the left cell.

If you submit the calculation electronically or print it out on a printer, there is no need to put dashes in unfilled cells (clause 2.21 of the Filling Out Procedure, approved by Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551).

- Important:

- On all pages of the new calculation, at the top, immediately after the fields for INN and KPP, there is a field “Last name __________I.___O.___”. This field is filled out only by individuals who are not registered as individual entrepreneurs and did not indicate their TIN in the calculation. Companies leave this field blank.

Calculation of insurance premiums for the 2nd quarter of 2017: example of filling out section 3

You need to start filling out the calculation of contributions from section 3. It reflects information about each employee, his income and insurance premiums.

Section 3 must be drawn up for each individual with whom an employment or civil contract has been concluded. It has two pages. On the first, enter your personal information, on the second, the amounts of payments and insurance premiums.

On line 010 of the initial calculation of insurance premiums for 2017 (an example of filling is below), indicate “0-”. If you adjust data for six months, then in the updated calculation you will need to put the adjustment number (for example, “1-”, “2-”, etc.).

In field 020, write down the reporting period code - 31, in field 030 put the year - 2017. In field 040, indicate the serial number of information about the employee. And in field 050 - the date of submission of the contribution report.

- For your information:

- In line 040 you can enter the employee’s personnel number. But it is more convenient to number starting from one. Since, for example, performers under contract agreements do not have a personnel number.

In lines 060-150, write down the INN, SNILS, full name, date of birth, series and number of the passport.

The control ratios for the calculation now say that tax authorities will only check SNILS and full name. But an error in the TIN and passport data is also dangerous. If your program contains incorrect data about an employee, it may go to other reports, for example 2-NDFL and SZV-M.

The fine for each certificate with an error will be 500 rubles. The fine for an incorrect TIN in SZV-M is also 500 rubles, but the fund multiplies it by the number of people in the report who have an error in this detail.

In lines 160-180, enter code 1 if the employee is insured in the system of compulsory pension, medical and social insurance. And code 2 - if he is not an insured person.

See the sample for how to fill out the calculation of insurance premiums.

Sample of filling out calculations for insurance contributions to the Federal Tax Service in 2017

There are two subsections on the second page of the section. In subsection 3.2.1 (columns 190-240 and line 250) - write down pension insurance contributions at a general or reduced rate, in subsection 3.2.2 (columns 260-290 and line 300) - contributions at additional tariffs.

Each month of the reporting quarter corresponds to its own block, columns 220, 230 and 240. Tax officials placed them one below the other.

In column 190, write down the serial number of the last three months of the reporting period. When calculating insurance premiums for the 2nd quarter of 2017 (an example of filling is below), enter 04, 05 and 06.

In column 200, indicate the category code of the insured person from Appendix 8 to the Procedure for filling out the calculation of insurance premiums. The code for employees under employment contracts is HP.

In column 210, write down the total amount of payments to the employee for the six months. In column 220, indicate the base for pension contributions within 876,000 rubles. Line 240 contains contributions from this base.

In line 230, enter payments to contractors. If you only entered into employment contracts with “physicists,” show zeros in lines 230. Column 250 for general values.

Sample of filling out the calculation of insurance premiums for the 2nd quarter of 2017

How to fill out subsections 1.1 and 1.2 of the calculation of insurance premiums

The calculation of pension insurance contributions is shown in subsection 1.1, medical - in subsection 1.2. In line 001, provide the tariff code from Appendix 5 to Order No. ММВ-7-11/551. For companies with a general tariff - code 01.

The subsection on pension contributions differs only in additional lines - 021, 051, 061 and 062. In them, include accruals above the maximum base and the number of individuals who received them.

On line 030 in both subsections show payments that relate to the subject of insurance premiums (clause 1 of Article 420 of the Tax Code of the Russian Federation), on line 030 - non-taxable payments. Show the contribution base on line 050, and the contributions themselves - on line 060.

When calculating contributions for the first half of 2017, the total amount of contributions to the Pension Fund as a whole for the company must coincide with the amount of contributions for all individuals for each month. Otherwise, the inspectors will not accept the calculation (clause 7 of Article 431 of the Tax Code of the Russian Federation). Therefore, before sending the calculation, check the indicators of section 3 and subsections 1.1, 1.3.1 and 1.3.2.

Sample of filling out the calculation of insurance premiums

Filling out the calculation of insurance premiums in 2017 with sick leave (Appendix 2)

In the second appendix, show calculations for contributions in case of temporary disability and in connection with maternity.

If there is a pilot project in the region, enter code 1. Enter code 2 in field 001 if you pay benefits to employees yourself and then reimburse expenses through the fund.

The design algorithm for the second application is the same as in subsections 1.1 and 1.2. But there are differences. In line 010, do not show performers under GPC agreements, since they are not insured against illness and maternity. However, remuneration to performers must be shown in lines 020 and 030.

In line 070, show expenses from the Social Insurance Fund. Do not take into account sick leave for the first three days of an employee’s incapacity for work (letter of the Federal Tax Service of Russia dated December 28, 2016 No. PA-4-11/25227@). Show the amount including personal income tax.

Calculation of insurance premiums in 2017, example of filling out sick leave

Calculation of insurance premiums 2017: example of filling out Appendix 3

If you paid employees benefits, detail the data about them in Appendix 3. If there were no expenses, do not fill out the application.

Reflect in lines 010-090 for each type of payment the number of cases, the number of days paid, as well as the amount of expenses.

On lines 010 and 011, show benefits to Russians and citizens from EAEU countries (clauses 12.6 and 12.7 of Procedure No. ММВ-7-11/551). On lines 020 and 021 - payments from the Social Insurance Fund to temporarily staying foreigners.

Report on insurance premiums in 2017 (filling sample)

How to fill out section 1 of the calculation of insurance premiums for the first half of 2017

Section 1 of the calculation contains summary information about contributions that need to be transferred to the tax office based on the results of the first half of 2017.

If you need to indicate several BCCs, fill out the required number of sheets in section 1 with all lines from 060 to 073.

How to fill out a report (calculation) on insurance premiums for the 2nd quarter of 2017

Filling out the calculation of insurance premiums in 2017: cover page for the 2nd quarter of 2017

On the title page, indicate the name of the company, INN, KPP, type of activity code according to OKVED.

In the “Adjustment number” field, enter “0--” if this is the primary calculation for the reporting (settlement) period. Next, enter the reporting period code - 31 and the year - 2017. Then write down the code for the location: for the company - 214.

In the “Contact phone number” field, enter the phone number in the following format: 8, code, number. Between 8 and the code, as well as between the code and the number, make spaces, do not put dashes.

In the special fields of the title page, write down the name of the policyholder, indicate the date of the calculation and sign. If the calculation is submitted by a representative, then an additional copy of documentary evidence of authority should be attached to the reporting.

Calculation of insurance premiums (filling example)

How the Federal Tax Service checks the calculation of insurance premiums

In the new calculation of contributions, 310 control ratios from the letter of the Federal Tax Service of Russia dated March 13, 2017 No. BS-4-11/4371 must be fulfilled. Another 186 formulas were proposed by the FSS (letter dated June 15, 2017 No. 02-09-11/04-03-13313).

Tax officials will look at whether the amount of pension contributions that the company calculated for the last quarter coincides with the accounting data for the same period. If there is a discrepancy, the inspectors will return the calculation to the company and demand that the error be corrected (clause 7 of Article 431 of the Tax Code of the Russian Federation).

In addition, inspectors will check whether the personal data of individuals in the calculation matches the information that is in the inspection database. If there are errors, you will have to redo the calculation. The inspection will also compare current and past payments.

It is important that the company calculates accruals on an accrual basis from the beginning of the year correctly. To check this, officials will add to the total amount of accrued contributions from the previous report the amount that the company accrued over the last three months. If the result is less than the total current amount, inspectors will decide that you incorrectly transferred amounts from previous statements into the calculation. Inspectors will also check whether the calculated contributions for the quarter coincide with the amount payable.

What to check before filling out a contribution calculation

|

What to prepare in advance |

Where to show in calculations |

Why is it dangerous to make a mistake? |

|---|---|---|

|

Code of main activity OKVED2 |

Title page |

Tax authorities will ask for clarification |

|

New BCCs for insurance premiums |

In the inspection database, payments will not conflict with accruals for insurance premiums. There will be confusion |

|

|

The number of people for whom you pay contributions, including additional tariffs |

First and second appendices to section 1 |

Control ratios do not match, tax authorities will ask for clarification |

|

Average number of employees for 9 months of 2016 and for the first quarter of 2017, if you have an IT company at a reduced rate |

Appendix 5 to section 1 |

If the average number is less than 7 people, tax authorities will suspect that you are illegally applying a reduced tariff. The Inspectorate will request clarification |

|

Total simplified income, if you apply a reduced tariff, and separately from the main type of activity |

Appendix 6 to section 1 |

If the share of income from core activities is below 70 percent, tax authorities will ask for clarification. They will doubt whether they are entitled to a reduced tariff |

|

Personal data of employees - TIN, SNILS, passport series and number |

Inspectors will ask you to redo the calculation if your personal data does not match their database |

What two mistakes did accountants make in the first contribution report?

Accountants made the most mistakes in the personal data of employees. To correct such errors, it is necessary to add sections 3 to the clarification only for those people in whose personal data there were errors. Do not include other employees in the calculation.

You need to fill out not only subsection 3.1 with the correct full name, SNILS and TIN of the employee, but also subsection 3.2. It will reflect the employee’s payments and contributions from the primary calculation.

In Section 1, provide the total contributions for all employees - simply transfer them from the original calculation.

Another common mistake is mixing up employee contributions. The accountants filled out subsection 3.1 for one employee, and inadvertently included payments for another employee in subsection 3.2. As a result, the total amount of contributions for all sections 3 agreed with the amount from section 1, but the contributions between employees were mixed up.

This problem needs to be eliminated, as it leads to confusion with charges and payments in the database of tax authorities and the Pension Fund of the Russian Federation. Include only those employees whose contributions need to be adjusted.

For each employee you add to the clarification, fill out Section 3 completely. That is, it is necessary to show not only the correct contributions of these people in subsection 3.2, but also their personal data in subsection 3.1.